5 Payment Gateway Terms Every Merchant Should Know

Payment gateway is a wide term that encompasses much more information than just a gateway for making payments. Due to technological advancements, more and more payment gateways are coming up in the e-commerce business platforms. Therefore, it might be difficult for newcomers in the business world to choose the best payment gateway. This makes it even worse when they come across a wide range of jargon and industry-related terminologies.

If you want to get more information on payment gateways, click to learn more.

So as a merchant of an e-commerce business platform, it is important that you have a clear idea about the certain terms associated with payment gateways before you choose the best one for your business proceedings.

Terminologies in Payment Gateways

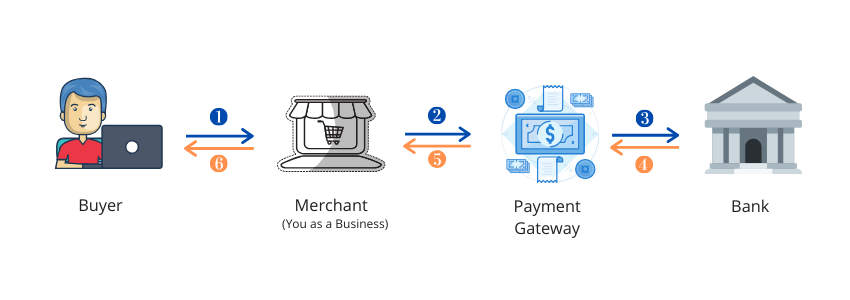

A payment gateway is a kind of technology that e-commerce business platforms use to accept online payments from customers. It plays a vital role in authorizing the transaction process between merchants and customers. This service can be directly provided by the banks or by a payment service provider authorized by banks. But before making transactions or choosing a payment gateway, the merchants must have an idea about some of the jargon of the payment gateway. Here are some of the most important ones:

Acquiring Bank

This is probably the most heard term when you are choosing a payment gateway. Acquiring Bank is a financial institution that maintains the accounts for the e-commerce businesses in order to accept online payments. It settles card transactions for the merchants’ accounts. At times, the payment processor and acquirer are also the same.

Issuing Bank

The Issuing Bank is a financial institution that processes online payments on behalf of the customers. It is also known as Issuer and it acts as a bridge between the customers and the card network. The main role of an issuing Bank is to authorize the transaction from the customer’s end, in order to complete the transaction process. It also verifies if the cardholder has enough funds in his account for making payments or not before approving the transaction.

PCI Compliance

Whenever you are making transactions through payment gateways, security is the foremost thing that needs to be ensured. PCI compliance refers to compliance with the terms and conditions of PCI-DSS (Payment Card Industry Data Security Standard). It is a security protocol that is applicable to entities involved in storing, processing, and transmitting the card details for payment. Therefore, it is necessary for all merchants to comply with the PCI standards in the payment gateways, failure which may lead to data breaches and other problems.

Chargeback

A Chargeback is a dispute against a transaction process, raised by a cardholder and reported to the issuing bank of the customers. It happens when the transaction is proven fraudulent and in such cases the bank refunds the entire amount to the account of the customers. Therefore, it is a kind of protection for the customers but can be a reason for incurring huge losses for the merchants.

Business Identifier Code (BIC)

This is also one of the most common terms that are associated with payment gateways. BIC is a specific numeric sequence that refers to a banking affiliation operating within different territories. This code is applicable to both financial and non-financial institutions. Whenever you make transactions, this digital information is received by your bank along with other details.

While things are not limited to these terms, one can easily make the most out of them. Once you get familiar with the concepts behind these terms, things will get easier for you. And with the right knowledge about a payment gateway, you can use their services in a more effective and efficient manner.